King dollar dominates the world market in the present day. Most international debt is denominated in dollars, most world banks hold lots of USD, and most transactions between countries use the Eurodollar (a cousin to the US Dollar that pairs it with futures contracts). How did this come to be? What made the US Dollar so important that most of the world adopted it as the reserve currency of choice?

1. Gold

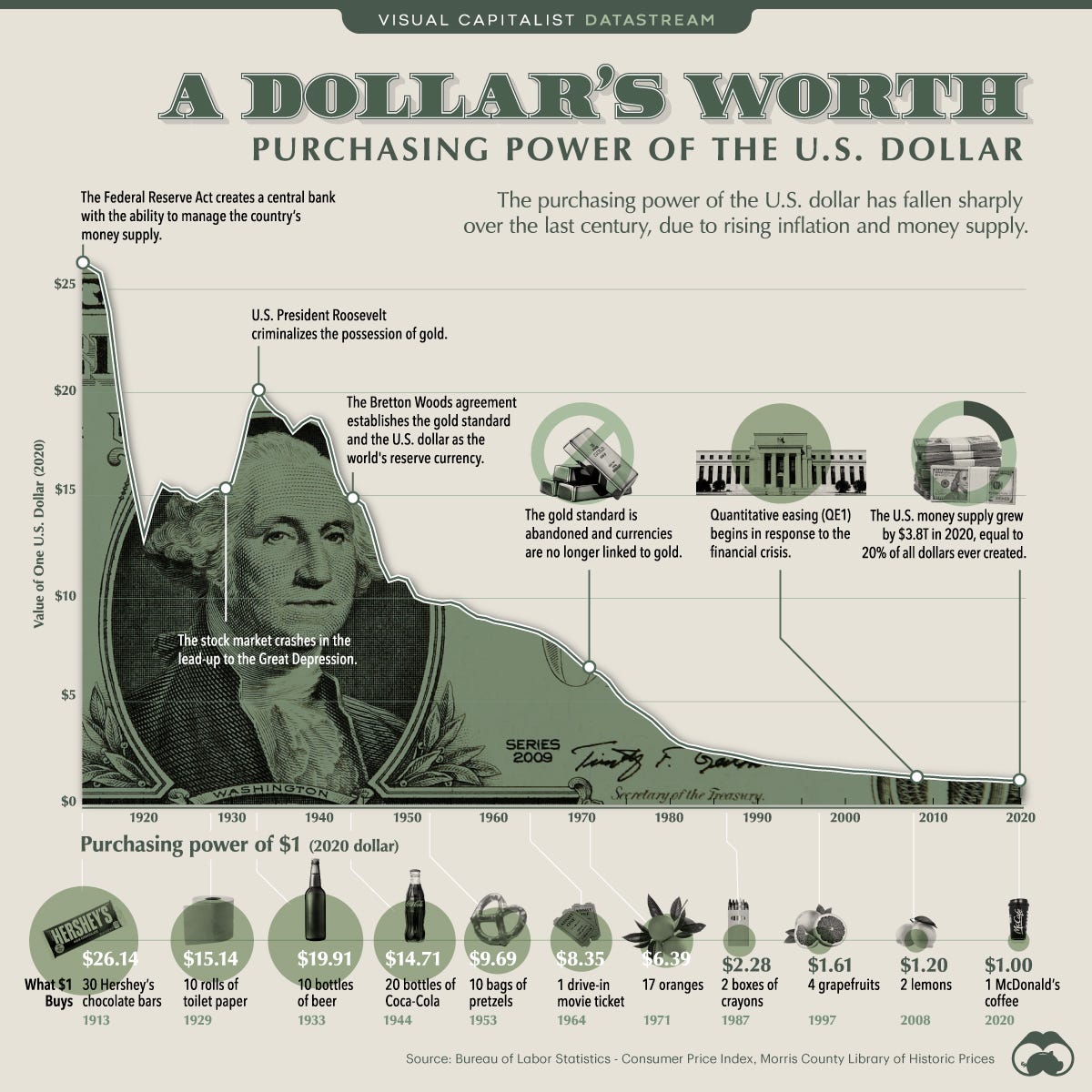

That’s right, the US Dollar can thank its’ success in the global market place to gold. The first modern dollar was printed in 1914. It was backed by gold & silver and was created as a part of the founding of the US Federal Reserve Bank. If you haven’t, read The Creature from Jekyll Island. It will change everything you think about the US Monetary system. Amazon link: https://a.co/d/701oL7j

Prior to that time, currency was printed by private banks independently. It took an additional 30 years before the USD rose to supremacy on the world stage. In the early 1900’s, the British Pound was still the big Kahuna. However, World War I and World War II changed everything. Most industrialized countries had currency linked to gold and/or silver. But the war efforts pushed them to inflate their currencies and deficit spend to finance the war machines. The United States was a major arms/equipment dealer to Europe during World War II specifically. Part of the reason companies like Catepillar are global equipment dealers that can deliver large, expensive equipment on short timelines is because of their buildout during World War II and directly financed by US taxpayers. But I digress.

Europe and specifically the United Kingdom paid the US in gold. At the conclusion of World War II, the US possessed over 50% of the world’s gold reserves. Most of the participants in World War II ended that war damaged and with their coffers nearly empty. My ADD is kicking in and now I’m thinking about Switzerland giving exile to European Jews but taking their gold. But that’s far afield for this discussion.

In 1944, the Bretton Woods Agreement established the US Dollar as the world reserve currency with all other foreign currencies pegging their values to the USD.

2. Military Might

Most empires throughout history that have dominated large areas of the Earth have had one thing in common…a big, strong military. Rome, Britain, and the United States are the most commonly known examples of this. Why? The answer is trade routes. You can’t have a global influence without trade. And even more importantly, he who controls the trade routes has all of the world economy in their grasp. Getting goods and people between two places is costly and dangerous. Look no further than the current conflict in the Middle East and how the Houthi’s in Yemen have snarled trade in the Eastern Hemisphere.

At the end of World War II, the US lost many soldiers but nearly as many as other countries and also benefited from being half a planet away from the fighting. The US mainland saw no damage and the build up for the war effort made America the dominant industrial super power. It also had created one of the most expansive militaries in human history. This included a huge build up of its’ navy. Part of the reason Britain was the world reserve currency up until 1944 was due to its’ naval superiority and ability to protect trade routes throughout the world. A role they now ceded to the US.

3. Demographics

The Baby Boomers are an entire generation conceived and birthed following World War II. GI’s returning from war started families they had held off on while overseas and the general economic health of the United States supported a huge boom in birth rates. This in turn kept the average age in the US at or below 30 years old throughout the 50’s. Countries with a large, young workforce have the main building blocks for a boom in industrial production due to high productivity and low cost labor. Add in the 51% of the population being welcomed into the workforce (ie women) and you have the recipe for a dramatic increase in economic activity and huge export surpluses bringing money into the country from all over the world.

What is Threatening its’ Reserve Currency Status?

Decoupling from the gold standard starting in the 1930’s but culminating in 1973

US deficit spending that effectively exports inflation to emerging markets throughout the world

Dropping US birthrates and a rise in average age

Globalization in the form of trade agreements that circumvent the US and even use of the US dollar as an intermediary for those exchanges

A shift to a more digital infrastructure globally (the race is now for control of the virtual landscape to control global trade in cyberspace)

Constant, and increasingly expensive military interventions/conflicts throughout the world

Heavy handed regulation that stifles economic growth and innovation within the US

The cumulative effect of all of the above that undermines global faith in the US Dollar and its’ dependability as the reserve currency of choice

*Get something out of this article? Awesome! Please let me know in the comments, share it and subscribe. It would help a lot!

***Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation.